november child tax credit deposit

You qualify for the full. 205 for qualifying children under the age of 18.

All You Need To Know About The New Child Tax Credit Change

The payments will be made either by direct deposit or by paper check depending on what.

. You will get the additional one-time GST credit payment if you were entitled to receive the GST credit in October 2022. Future payments are scheduled for November 15 and December 15. Payments will be issued automatically starting.

Free means free and IRS e-file is included. The day will also mark. The Child Tax Credit helps families with qualifying children get a tax break.

Heres what to know about the fifth. Thats an increase from the regular child. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving monthly Child Tax.

While the deadline to sign up for monthly Child Tax Credit payments this year was November 15 you can still claim the full credit of up to 3600 per child by filing a tax return next year. Check How to Qualify for the Child Tax Relief Program with Our Guide. 2022 You will not receive a monthly payment if your total benefit amount for the year is less than 240.

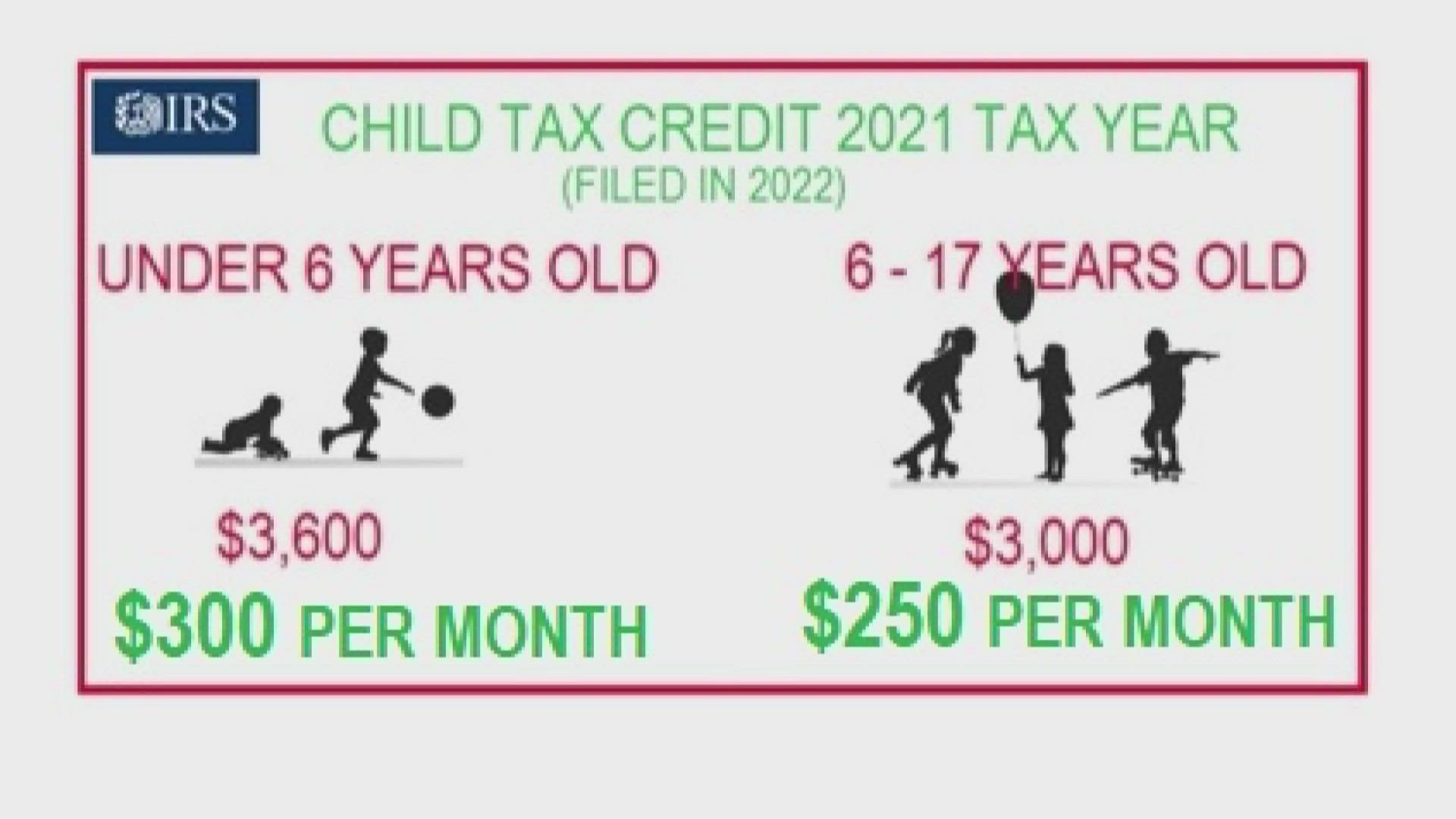

The IRS is paying 3600 total per child to parents of children up to five years of age. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. 15 opt out by Aug.

Under the Biden administrations 2021 American Rescue Plan the child tax credit was expanded from 2000 per child to 3000 per child for children over the age of six and. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 through 17 for 2021. For these families each payment is up to 300 per month for each child under age 6 and up to 250 per.

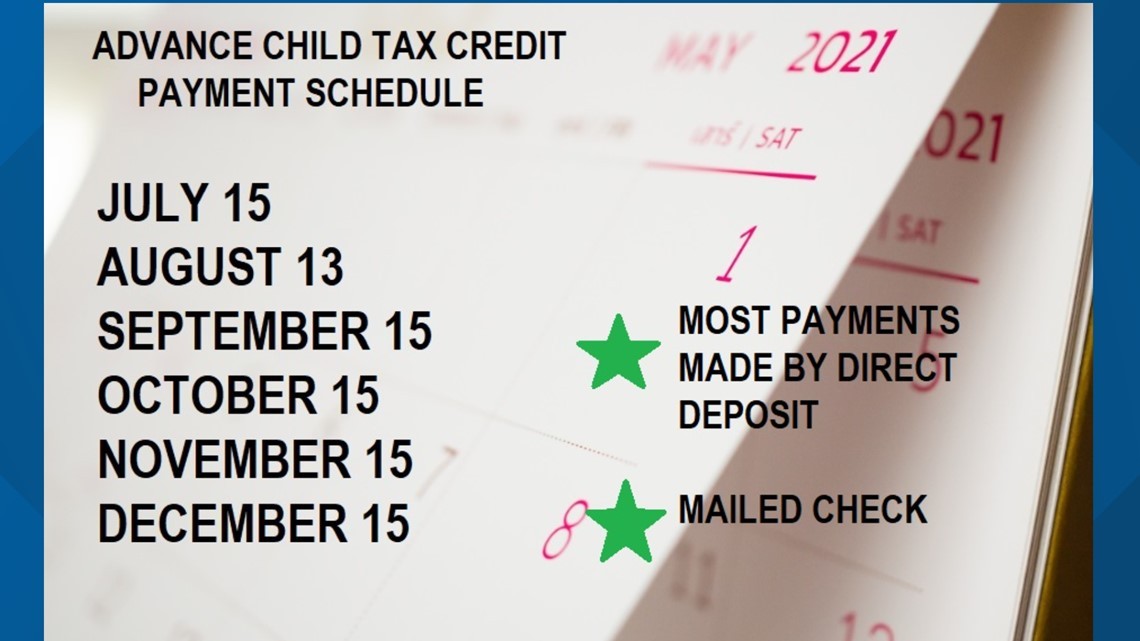

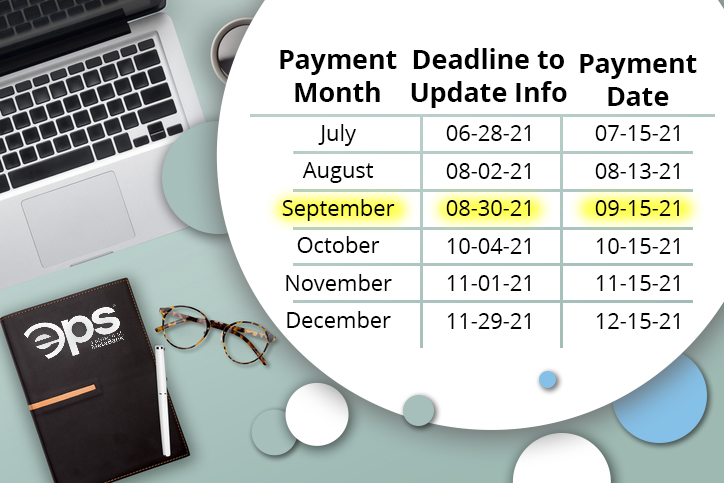

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. WASHINGTON On Monday November 1 the Internal Revenue Service will launch a new feature allowing any family receiving monthly Child Tax Credit payments to update their. You may be able to claim the credit even if you dont normally file a tax return.

Ad The 2022 advance was 50 of your child tax credit with the rest on the next years return. Low-income families who have not received advance payments because they do not typically file a tax return have until Monday night Nov. The CRA makes Canada child benefit CCB payments on the following dates.

15 to sign up to receive a lump sum. Thats 300 per month 3600 12 for the younger child and 250 per month 3000 12 for the older child. The November installment of the advance child tax credit payment is set to start hitting bank accounts via direct deposit and through the mail next week.

To be eligible for advance payments of the Child Tax Credit you and your spouse if married filing jointly must have. 13 opt out by Aug. Ad Review the Guidelines and Steps to Apply for the Child Tax Relief Program With Our Guide.

That drops to 3000 for each child ages six through 17. For now parents of about 60 million children will receive direct deposit payments on October 15 while some may receive the checks through the mail anywhere from a few days. 6 Often Overlooked Tax Breaks You Dont Want to Miss.

Learn More at AARP. 23 hours agoNew claims for Pension Credit. Those payments will last through December.

Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on. November child tax credit. The IRS will issue advance Child Tax Credit payments on these dates.

Eligible residents can claim a credit up to 500 for each child under the age of six. The expanded tax credit delivers monthly payments of 300 for each eligible child under 6 and 250 for each child between 6 to 17 years old. You can claim the.

Half of the total is being paid as. July 15 August 13 September 15 October 15 November 15 and December 15. As part of President Joe Bidens American Rescue Plan qualifying families have been receiving monthly payments worth up to 300 per child.

13 opt out by Aug. Max refund is guaranteed and 100 accurate.

Last Day To File Your Child Tax Credit Is Nov 15 Wjet Wfxp Yourerie Com

Monthly Payments For Families With Kids The 2021 Child Tax Credit United For Brownsville

Child Tax Credit Did Not Come Today Issue Delaying Some Payments Kare11 Com

Child Tax Credit November Payment Is Second From Last What To Know

Stimulus Update Some People Could See A Larger Child Tax Credit Check In December Al Com

Mothersoutreach On Twitter Parents The Registration Deadline For The Advance Child Tax Credit For 2021 Is Midnight Monday 11 15 Go To Https T Co Etkoyafmyv Amp Register Still Have Questions Attend Our Final Free Parents

Your Child Tax Credit Payment Just Arrived Are You Sure You Want It Wsj

Child Tax Credit Updates To Know For November Gobankingrates

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

The Child Tax Credit The White House

Nov 15 Is Deadline For Nonfilers To Claim Enhanced Ctc Don T Mess With Taxes

Child Tax Credit Fight Reflects Debate Over Work Incentives Wusa9 Com

Absence Of Monthly Child Tax Credit Leads To 3 7 Million More Children In Poverty In January 2022 Columbia University Center On Poverty And Social Policy

November Deadline For Child Tax Credit Payment Just Two Days Away Before Next Round Of Cash Sent Out The Us Sun

When Will You Get The Child Tax Credit Payment In November 2021

Irs Investigating Why Some Families Didn T Receive September Child Tax Credit

Abc7 Tens Of Millions Of Families Have Been Sent The First Payment Of The Expanded Child Tax Credit The Irs And The Treasury Department Said If You Re One Of Those Families